Chapter 2 Net Income Lesson 2.5 Group Health Insurance Answers

Applied Chapter 2 Book - Net Incomepdf - Google Docs. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators.

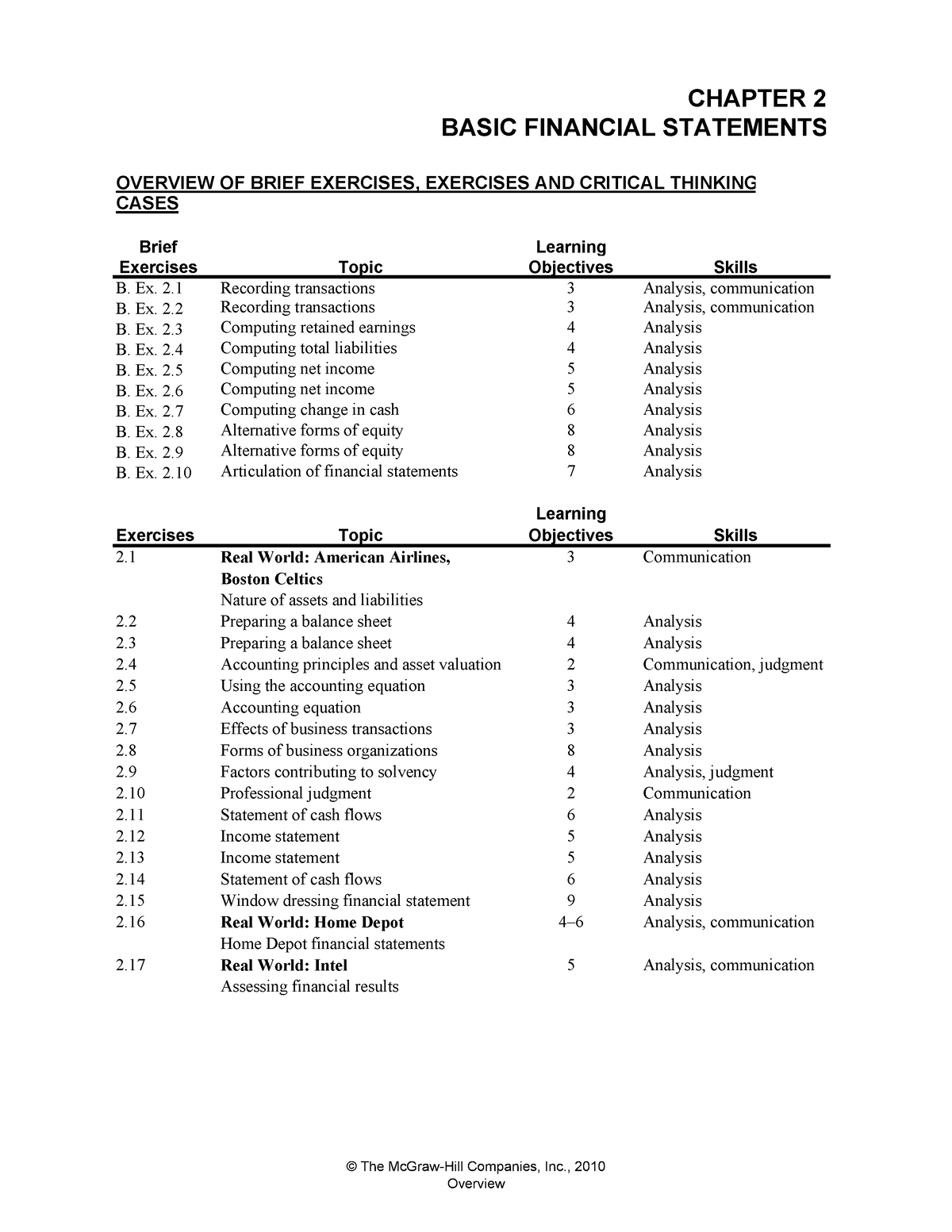

Chapter 2 Solutions The Basic Financial Statement The Financial And Managerial Accounting Brief Studocu

2 Computing total liabilities 4 Analysis B.

. 25 Group Health Insurancenotebook 3 September 16 2016 Find the deduction per pay period. 120 Chapter 2 Net Income CONCEPT CHECK Check your answers at the end of the chapter. Group Health Insurance Subject.

Money withheld by an employer from an employees paycheck to pay federal government taxes. The amount of money you receive after deductions are subtracted from your gross income. 50 P a g e Lesson 5.

Lesson 25 Group Health Insurance - Pg. Chapter 2 Net Income Lesson 21 Federal Income Tax - Pg. Annual cost of insurance.

129 READ and do 1-25 ODD 21 SOLUTIONS. Terms in this set 8 federal income tax. Includes tutorials practice quizzes flash cards and many more resources to help with your academic success.

Withholding allowances which allow for supporting. The total amount of money you earn. Find the taxable wages and the annual tax withheld.

State income tax rate is 15 percent of taxable. Tax Withheld per Pay Period Annual Tax Withheld Number of Pay Periods per Year. BALANCING THE ACCOUNTS OF THE GENERAL LEDGER LESSON.

Employers are not required by law to withhold a certain amount of pay for federal income tax. Calculate the deductions for group insurance Vocabulary. Net Income Chapter 25 Group Health Insurance Objectives.

139 READ and do 1-9 ODD 13-23 ODD. Income tax in which the tax rate increases different levels of income. THE EFFECT OF TRANSACTIONS ON THE FINANCIAL POSITION OF THE ENTERPRISE LESSON 23.

2 Computing retained earnings 4 Analysis B. Chapter 2 an introduction to cost terms and purposes. The number of people an employee supports which helps employers know how much money to withhold for federal income tax.

Chapter 2 Net Income 25 Group Health Insurance Objectives. Calculate the deduction for group health insurance. 12 pay periods 4.

It is not possible to have zero withholding allowances when calculating income tax. Many businesses offer to pay for health insurance because group insurance.

7sk62aevpizoam

Federal Income Tax Fit Pdf Free Download

The Market Reform In Dutch Health Care

Links Between Growth Inequality And Poverty A Survey1 In Imf Working Papers Volume 2021 Issue 068 2021

Coronavirus Outbreak Live Updates On Covid 19 Modern Healthcare

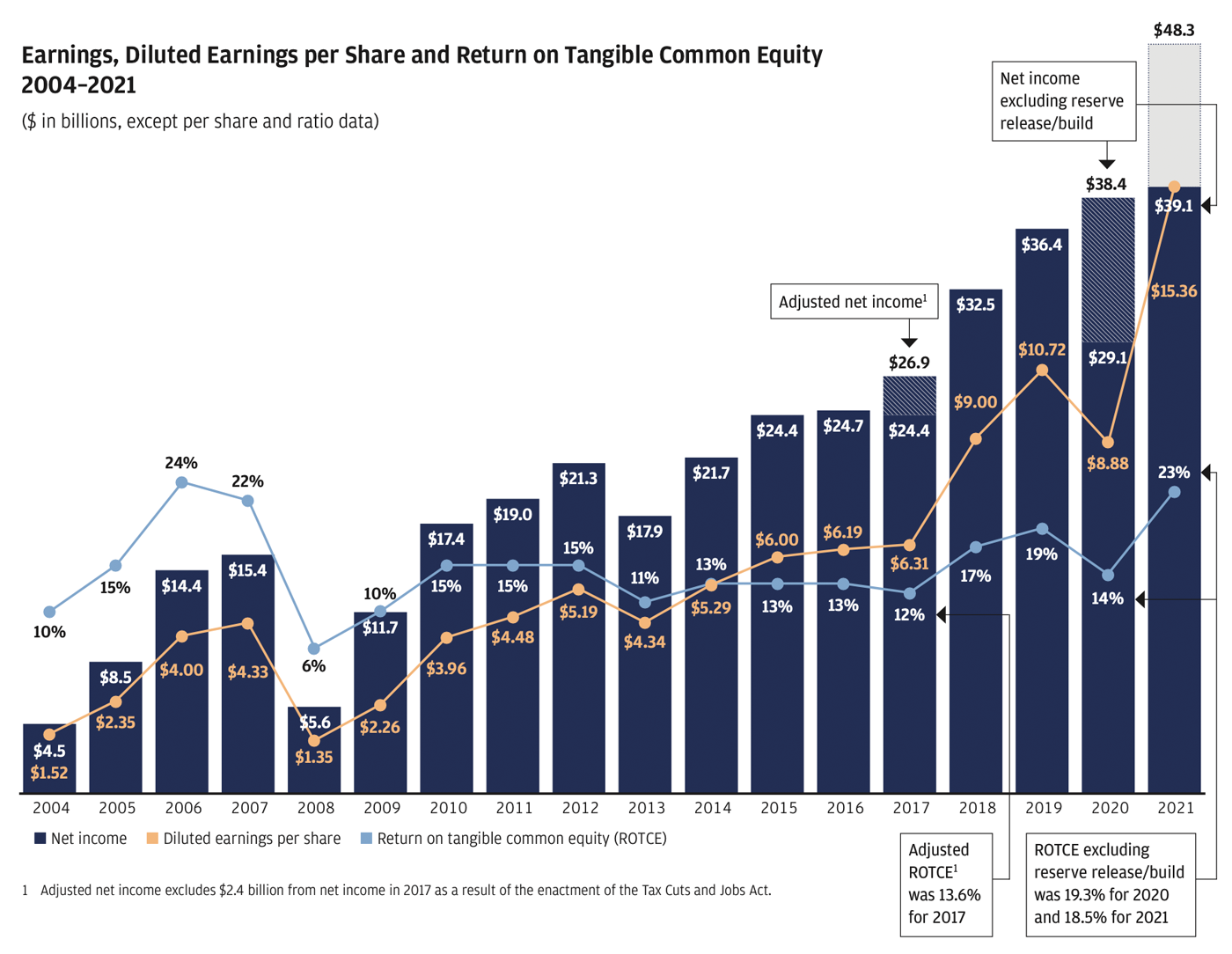

Jamie Dimon S Letter To Shareholders Annual Report 2021 Jpmorgan Chase Co

Assessing Internet Development In Germany Using Unesco S Internet Universality Roam X Indicators

Federal Income Tax Fit Pdf Free Download

End The Tax Exclusion For Employer Sponsored Health Insurance Cato Institute

A Public Option For Health Insurance In The Nongroup Marketplaces Key Design Considerations And Implications Congressional Budget Office

Section 2 5 Pp Group Health Insurance Ppt Download

Movement Led Institutional Change Uncertainty Networks And The Diffusion Of Contentious Practices In Organizational Fields Emerald Insight

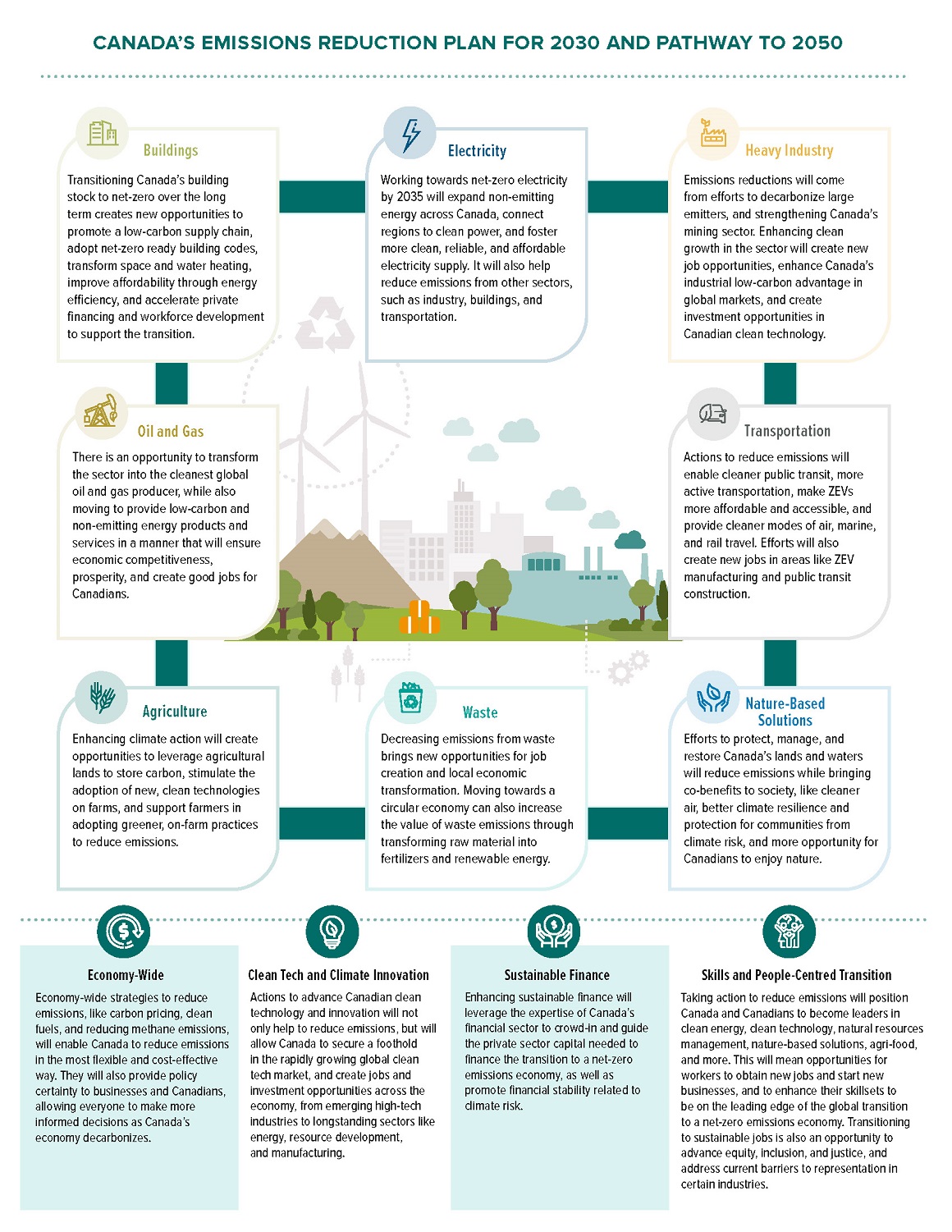

Canada S 2030 Emissions Reduction Plan Chapter 2 Canada Ca

Social Security United States Wikipedia

Section 2 5 Pp Group Health Insurance Ppt Download

2022 Southern Medical Research Conference Journal Of Investigative Medicine

Bjdqnrjvuckxqm